Civil Law Litigation for Land Ownership Issues is a critical tool to combat fraudulent financial practices, offering legal avenues for justice and compensation. It involves comprehensive investigations, robust strategies, and expert analysis to secure defense verdicts in complex cases. This process ensures accountability, compensates victims, and resolves disputes related to economic crimes, particularly in real estate fraud. Proactive measures like robust audits, internal controls, staff training, and staying informed about legal frameworks can mitigate risks and promote transparency.

Fraudulent financial practices pose significant challenges, undermining trust and stability in various sectors. This article explores a comprehensive guide to understanding and addressing these illicit activities. We delve into different aspects, including recognizing fraudulent schemes, civil law litigation as a powerful tool for justice, and strategies to prevent and detect frauds effectively. Additionally, we shed light on land ownership disputes, highlighting the legal recourse available through civil law litigation for resolving such complex issues.

- Understanding Fraudulent Financial Practices

- Civil Law Litigation: A Tool for Justice

- Land Ownership Disputes and Legal Recourse

- Strategies to Prevent and Detect Frauds

Understanding Fraudulent Financial Practices

Fraudulent financial practices refer to a wide range of illegal activities aimed at gaining an unfair advantage in the realm of finance and business. These practices can involve manipulation of financial statements, false representation of assets, or even complex schemes like Ponzi schemes and insider trading. Understanding these fraudulent activities is crucial for both individuals and institutions looking to protect their financial interests. Civil Law Litigation for Land Ownership Issues often plays a significant role in uncovering and addressing such practices, providing a legal framework to seek justice and compensation.

Winning challenging defense verdicts in civil cases related to financial fraud can be a complex task, requiring meticulous investigation and strong legal arguments. White-collar and economic crimes, including fraudulent financial practices, are typically handled under general criminal defense strategies, but the specific approach may vary based on the nature and extent of the fraud. By leveraging expert witnesses, thorough document analysis, and advanced investigative techniques, legal professionals can navigate these labyrinthine cases, ensuring that those responsible face justice and potential restitution.

Civil Law Litigation: A Tool for Justice

In the realm of justice, civil law litigation serves as a powerful tool to address fraudulent financial practices, particularly in cases involving land ownership issues. When individuals or entities engage in white-collar and economic crimes, such as fraud, the impact can be devastating for victims. Civil law offers an avenue for redress by allowing affected parties to seek compensation and restore their rights without necessarily relying on criminal proceedings.

This approach is especially valuable in avoiding indictment and focusing on the specific harm caused, whether it’s fraudulent land transactions or other economic crimes. Unlike general criminal defense strategies that aim to prove innocence, civil law litigation centers on determining liability and awarding damages. As a result, it provides an effective means to hold accountable those responsible for financial fraud, ensuring victims receive justice and a fair resolution.

Land Ownership Disputes and Legal Recourse

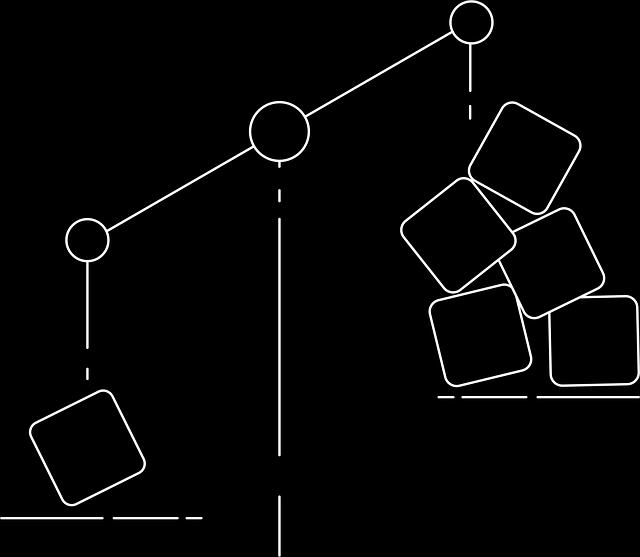

Land ownership disputes can be complex and emotionally charged, often leading to lengthy legal battles. When individuals or entities are involved in such conflicts, understanding their rights and available legal recourse is paramount. Civil law litigation for land ownership issues offers a structured framework for resolving these disagreements through the courts. This process allows parties to present their cases before judges or, in some jurisdictions, juries, who will ultimately decide on the rightful owner based on evidence and applicable laws.

In cases of fraudulent financial practices, such as those involving real estate transactions, victims may seek justice by invoking their legal rights. The unprecedented track record of successful white-collar and economic crimes cases further underscores the importance of robust legal mechanisms. Civil litigation provides a means to not only resolve disputes but also to ensure accountability and compensate affected parties for any financial losses or harm incurred due to fraudulent land ownership practices.

Strategies to Prevent and Detect Frauds

Fraudulent financial practices can be insidious and hard to detect, but proactive strategies can significantly reduce risks and encourage accountability. One effective approach is a comprehensive audit process that reviews all stages of financial transactions within respective businesses. This involves meticulous record-keeping, where every step of a financial deal is documented, allowing for easy verification and identification of any discrepancies. By implementing robust internal controls and training staff on fraud awareness, organizations can create a culture of vigilance.

Moreover, staying informed about legal frameworks, such as Civil Law Litigation for Land Ownership Issues, equips individuals and entities with tools to navigate and resolve disputes. Across the country, regulatory bodies play a crucial role in enforcing anti-fraud measures by monitoring financial activities and conducting investigations at all stages of the investigative and enforcement process. Collaboration between businesses, regulatory agencies, and law enforcement is essential to uncover and prevent fraudulent schemes, fostering an environment of transparency and integrity.

In light of the above, it’s clear that fraudulent financial practices can have far-reaching consequences across various sectors. By understanding these schemes and leveraging legal tools like civil law litigation for land ownership issues, we can seek justice and prevent further harm. While strategies to detect and prevent fraud are crucial, a robust legal framework ensures that those who engage in such practices face accountability. Together, these measures foster a more transparent and secure financial landscape.